Innovative AI technologies are transforming the landscape of mining exploration

The energy transition will require 6.5 billion tons of additional materials; 95 percent of this is steel, copper and aluminum, where known reserves are sufficient to meet demand. The other five percent are critical materials where there is a gap between predicted demand and known reserves, thus requiring exploration.

There are three main challenges with existing mining exploration that have created a technology gap for AI and other innovations:

- Material exploration is mostly field-based activity and is inefficient; existing mining exploration has a less than one percent success rate

- Materials are more difficult to access, as easy-to-access reserves have been depleted and many new mines will be underground

- We need critical materials to build the low carbon economy, but we don’t know where those materials are

Empowering the pre-discovery stage

The initial stages of a mine’s life cycle include the concept and pre-discovery phases, which can take around seven years. Although exploration stages are low-value,

high cost, and high risk, they have high potential. Paired with the rising demand for minerals and metals, exploration spending has risen significantly in recent years.

Traditional exploration is a field-based activity, were teams of geologists and mining explorers test for surface signs of minerals and then via boreholes. In general, miners are going in blind with little information of where and how to test. As a result, the process is labor intensive, time-consuming, and highly inefficient. There is a less than one percent success rate for exploration activities converting into commercial mines.

Technologies that are seeking to solve exploration challenges include:

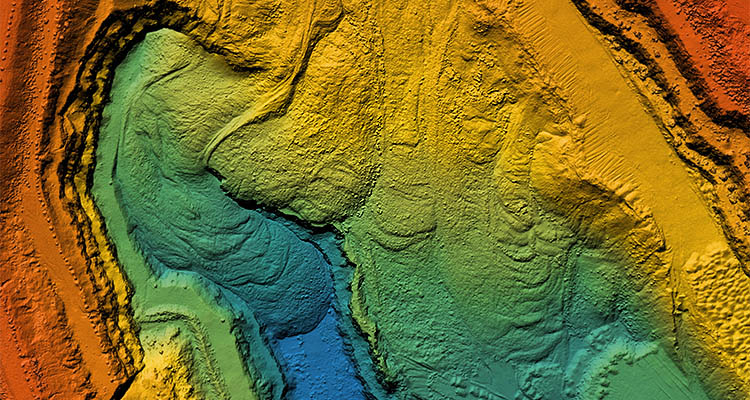

Advanced sensing like LiDAR or hyperspectral imaging technologies can provide more details and accurate estimations of ore quality, characterization, and location. For example, PlotLogic’s stacked LiDAR, hyperspectral imaging, and AI or machine learning analysis software increased the life of one of BHP’s iron ore mines in Australia by five years

AI machine learning data analysis can utilize large sets of primary and historic data, often held by mining companies, to predict site locations and site characteristics. VerAI’s proprietary AI software and sensor system, for instance, discovers mineral deposits with 100 times more accuracy, 20 times faster, and 20 times cheaper than current industry benchmarks

Surgical and precision drilling, such as Novomera’s surgical sensor-enabled drilling and software system, is estimated to reduce waste by up to 95 percent and costs by 50 percent. Novomera’s Near Borehole Imaging Tool (NBIT) is used to collect subsurface data, define ore-body geometry, and calculate the precision drill trajectory; the smart drill can course-correct as it travels down narrow veins and can then extract the deposit, with the waste is then backfilled to enable real-time environmental remediation

Scaling new technologies

These innovations are in the early stage, often in the pilot stages and yet to commercialize. The key buyers for these technologies are also the investors and partners, who are all major miners. Incumbents holding such an advantage include Australia’s BHP, Brazil’s Vale, and French multinational, Schneider. Each has investments or partnerships with innovators such as I-ROX, Novamera, and PlotLogic, with further potential afield. The value that they get from these technologies includes:

- Reduced CapEx. Companies are then able to shift labor and resource-intensive field exploration to a desk-based activity with AI and machine learning data analysis software

- Reduced OpEx. Targeted exploration is more efficient since it reduces exploratory drilling costs, labor, equipment, as well as reduces waste, which is costly to manage and clear

- New revenue streams. Technologies like surgical drilling can unlock previously uneconomic mineral sources or extend the life of existing mines

Challenging the norm

There are some interesting business models in AI exploration software. As mineral discoveries are rare, innovators don’t want to dilute the value of their discoveries by offering their model as a SaaS. As such, software developers are instead not becoming software providers but becoming smart mine owners or exploration companies themselves.

For example, VerAI acquired mining licenses, then utilized its machine learning searching capabilities to discover previously concealed mineral deposits. When they’ve made a discovery, they’ll then partner with exploration service providers to validate the discovery, as well as investors to fund later stages, in exchange for an equity share of the discovery.

Flexibility is key

So, what’s next? Whilst mining majors are making moves to pilot these technologies, they may not be the best to scale the technologies for impact due to:

- The scale of mining operations, as they are naturally inflexible with any delay resulting in significant costs, therefore piloting opportunities are few and far between

- A history of IP protectionism due to strong competition between majors

- It’s unclear if internal structures are established for scaling, or for uses beyond mining

Innovators will need to be selective in co-development with majors (which can narrow focus and limit scaling potential) and cautious about mergers seeking to hold IP for strategic advantage. It’s clear the mining industry is maturing when it comes to innovation, but with oncoming challenges and rising demand for critical materials including supply-demand fluctuations and trends of resource nationalism, flexibility in an inflexible system is required.

For a list of the sources used in this article, please contact the editor.

www.cleantech.com

Holly Stower is Cleantech Group’s Group Lead for resources and environment. Cleantech® Group is a research-driven company that helps corporates, the public sector, and investors identify, assess, and engage with innovative solutions and opportunities that are related to the world’s growing environmental and climate challenges.